Rising expenses and interest rates: How much can we control?

- October 24, 2022

Without rubbing salt in the wound, we all know fall is a difficult time for a farm’s cash flow. Milk cheques are often at their lowest at the end of summer, and field crops consume a lot of cash flow during this time as well, making autumn a difficult time of year in terms of your farm’s cash flow. In the current environment, with input price inflation and rising interest rates, the upcoming autumn looks to be financially challenging for many farms.

There are many uncontrollable factors we must bear in mind, but there are also factors that are within our control. The sooner we act, the sooner we can seize power over the factors within our control and effect a positive impact.

Beyond our control: Rising interest rates?

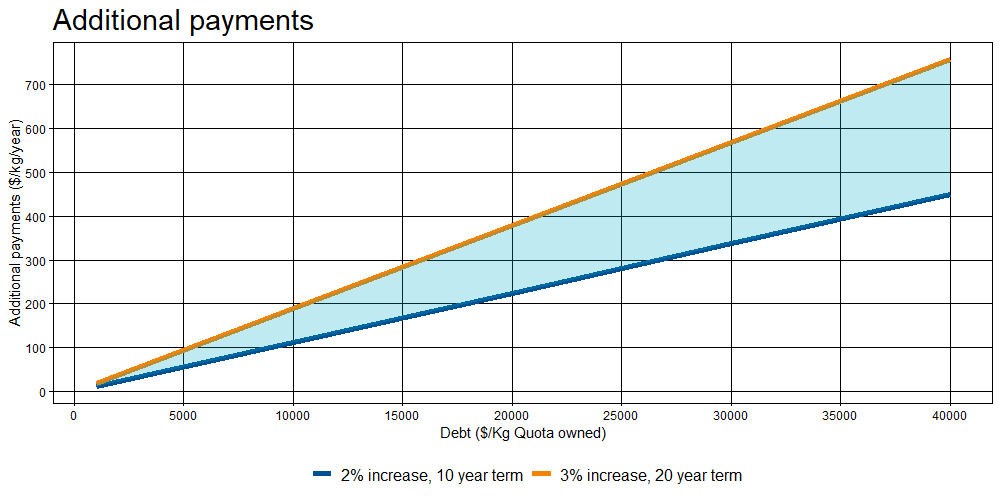

As we now know, the policy rate has increased severely over the last few months. Most dairy farms have a debt load that ranges from $15,000 to $30,000 per kilogram of quota held, and much of this debt is short-term. Therefore, rising interest rates directly affect the cost of capital for our farms, increasing payments and cash flow requirements.

How do I know where I stand?

Figure 1 shows the effects of interest rate increases from 2% and 3%, for debt with terms ranging from 10 to 20 years. For example, for a farm with $20,000 of debt per kilogram of quota on a 10-year term, a 2% increase in the interest rate translates to an additional cost of $225/kilogram/year, while a 3% increase in the interest rate on a 20-year term translates to an increase of $380/kilogram/year.

For a 100-cow farm with 113 kilograms of quota, this equates to an extra $2,000 to $3,500 per month.

Figure 1. Additional payments ($/kg/year) as a function of debt ($/kg quota owned)

Financial solutions?

Above all else, be aware that several financial solutions are usually available to you. Firstly, make a budget and monitor your cash flow to better understand the extent of your farm’s situation and to manage it.

Secondly, creditors may have solutions to offer, whether it is a debt restructuring or a capital payment forbearance. The availability of these solutions often depends on the farm’s financial position and the creditors’ confidence in its management. Therefore, maintaining good, open communication with creditors can be very beneficial, and even necessary, regardless of what the overall situation may be.

Be strategic: review and prioritize your investments

The cost of capital has remained abnormally low over the past 10 years. The Bank of Canada’s policy rate has remained below 1% for most of this period, and the rise in recent months signals a significant change in the economic environment. In this new environment, funds are and will be more expensive. As a result, we must double our efforts to make sure we are investing in the right assets and making them as productive as possible.

Do we have assets that we could do without? Can we make the assets we want to keep more productive by using them more, or more efficiently?

Among other solutions, there are asset-sharing arrangements that are relatively well known (co-ownerships, exchanges, and custom work). These arrangements require some effort in terms of managing business relationships, but they have the advantage of reducing the cost of owning assets, including interest and financial stress, without necessarily increasing variable costs or reducing revenues.

Being proactive on the farm—What factors can we influence today?

If we can’t avoid the storm altogether, let’s at least try to minimize the damage. Most solutions take a few months to deliver their full benefits. Where do we start?

Are there things we do out of habit that need to be reviewed?

Raising replacement animals

A lot has been invested in animal comfort and genetic choices focused on cow longevity. However, milk recording statistics for 2021 show a culling rate and a percentage of cows in their third lactation or higher, at levels like those seen 15 years ago. Have we forgotten to adjust the number of animals kept for breeding accordingly? Wouldn’t this be an excellent place to reduce monthly cash outflows without having a significant impact on the farm’s income?

Example: A Hundred Cow Farm, Inc.

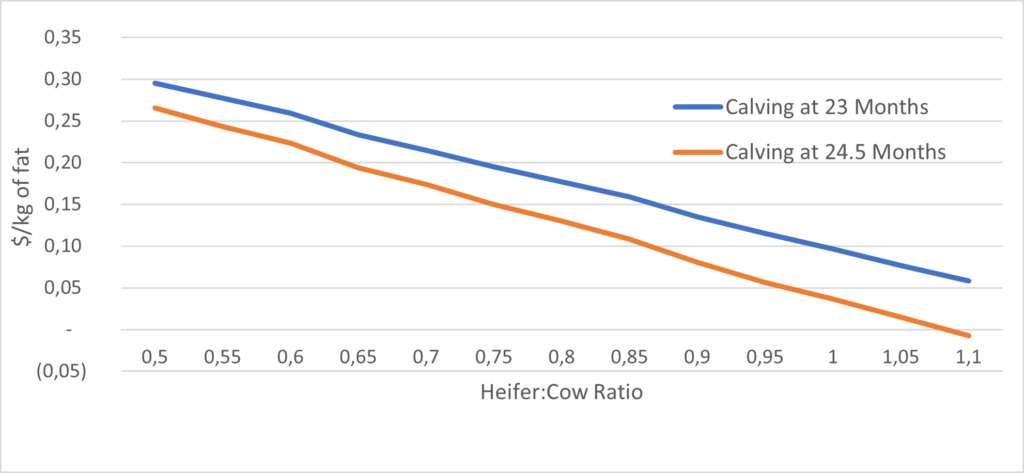

The farm has improved their breeding program and now have an average age at first calving of 24.5 months, giving them a heifer to cow ratio of 0.74; a result they are quite satisfied with. However, the farm remains concerned about the loan renewal scheduled for the end of the summer.

A quick analysis with their advisor reveals an underutilized potential: the current growth of the heifers would allow them to be bred 1.5 months earlier. By maintaining the herd health, the cows could easily average an extra half-lactation. The current cull rate of 34% would be reduced to 28%, allowing fewer heifers to be raised to replace the herd. The ratio of heifers to cows in the herd would then drop to 0.58.

1 Sales of culled cows and calves minus purchases of feed, veterinary fees, insemination, bedding, and registrations

Figure 2 shows the proposed changes would increase cash flow from $0.15 per kilogram of fat to $0.26 per kilogram. So even without reducing other costs, there would be a net positive impact on the bank account.

At first, cash flow changes will be negligible: one more calf sold, lower registration fees, less milk replacer, fewer vaccines, etc. But after a few months, the number of heifers in other groups will decrease resulting in less money spent on starter feed, supplements, breedings, etc. Thus, in less than a year, the farm’s liquidity improves by about $600 per month.

- Field-based solutions

Fall is often a time for assessment, when we need to make sure we get the most out of our forage. Crop yields are calculated, and decisions are made on the next varieties to be planted, crop rotations, forage acreage, etc. Do you also use this assessment to determine the best feeding strategy for your herd with on-farm inventories?

Here are, in our opinion, three of the best forage feeding strategies to maximize milk production while keeping costs reasonable:

Giving the best forage to the best cows

Our best cows have enormous nutrient needs, and often have energy deficits due to the difficulty of concentrating a ration while maintaining the health of the cow and the financial health of the farm. When the structure of the enterprise allows it, giving group 1 the best forages will allow us to concentrate the ration, providing one that is better adapted to our best cows, thus improving peak milk, and decreasing energy deficit issues.

Using corn silage wisely

Corn silage, as many people know, is a feed that improves in digestibility over time. It reaches its full potential 3 to 6 months after being put in the silo. Therefore, it’s wise to use this metric to your advantage. How many times have we witnessed producers feeding a lot of corn silage in the fall and having to cut back in the summer to avoid running out? The opposite should be done to maximize production.

For example, a 20 x 80 silo of corn silage fed at a rate of 20 kilograms per cow for the first six months, and a rate of 15 kilograms for the last six months, produces 7,000 fewer litres of milk than the same silo with a strategy of 15-kilogram feeding rate during the first six months and a 20-kilogram feeding rate over the last six months. This results in a difference of about $550 per month.

Young forage in the ration

For those who have been feeding very young hay, between 24%-28% ADF, the best strategy is to feed it at a reasonable rate for longer, rather than feeding too much for less time. The reason is simple: very young hay does not have time to be properly digested by the cow when fed in excess. The manure thins out and the nutrients end up in the pit. On the other hand, this type of silage is quite appropriate in a ration. Its palatability often increases feed intake and concentrates the ration. Therefore, if it is feasible on the farm, feeding it for a longer time in small doses will allow you to draw more milk with the same volume of silage through better absorption, in addition to increasing its stability.

In summary…

We know all farms are affected by the increase in input prices and the majority will see interest payments increase significantly in the coming months.

In our 100-cow farm example, we estimated their additional interest costs at $2,000 to $3,500 per month. But it is possible to recover most of the increase in interest costs by taking the opportunity to modify their rearing program, and ensuring they make the most efficient use of available forages.

Mastering change is never easy, but one key is to remain optimistic and on the lookout for these saving opportunities. In the long term this will pay off as the efficiency gains achieved in times of crisis will still be valid when the good days return.